The Greatest Guide To Hsmb Advisory Llc

Bureau of Labor Data, both spouses functioned and brought in income in 48. They would certainly be most likely to experience monetary difficulty as a result of one of their wage income earners' fatalities., or personal insurance you get for yourself and your household by speaking to health and wellness insurance business straight or going with a health insurance policy agent.

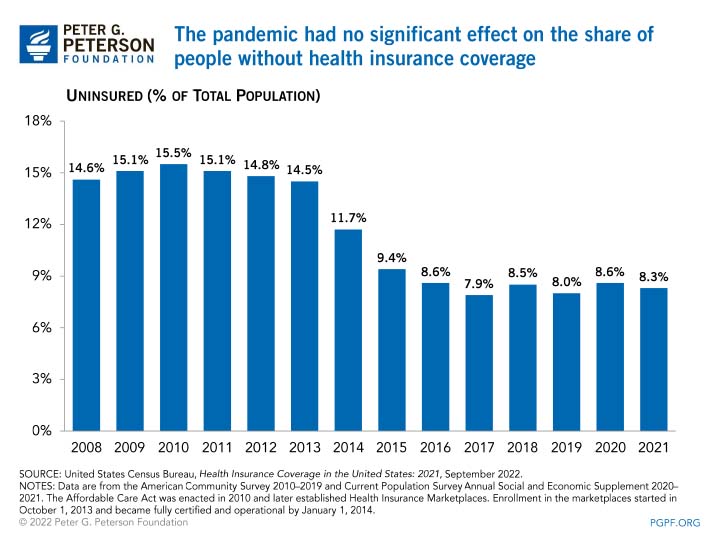

2% of the American populace was without insurance protection in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Statistics. Greater than 60% got their protection with a company or in the exclusive insurance policy marketplace while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' benefits programs, and the government marketplace developed under the Affordable Treatment Act.

Our Hsmb Advisory Llc Diaries

If your earnings is reduced, you might be one of the 80 million Americans that are eligible for Medicaid. If your income is moderate but does not extend to insurance policy protection, you may be qualified for subsidized protection under the federal Affordable Treatment Act. The best and least costly choice for employed workers is usually joining your employer's insurance program if your company has one.

Investopedia/ Jake Shi Long-term special needs insurance coverage supports those who come to be incapable to function. According to the Social Protection Management, one in four employees entering the labor force will end up being handicapped prior to they reach the age of retired life. While wellness insurance policy pays for a hospital stay and clinical bills, you are often burdened with every one of the expenses that your income had covered.

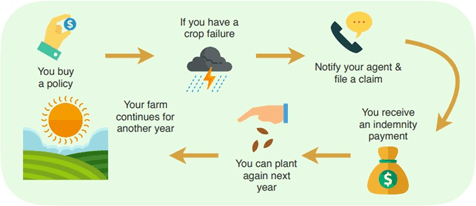

Before you acquire, check out the great print. Numerous plans call for a three-month waiting period before the insurance coverage begins, offer a maximum of three years' worth of coverage, and have considerable policy exclusions. Regardless of years of renovations in automobile security, an approximated 31,785 individuals passed away in website traffic mishaps browse around this site on united state

Not known Facts About Hsmb Advisory Llc

Comprehensive insurance coverage covers theft and damages to your vehicle because of floods, hailstorm, fire, criminal damage, falling objects, and pet strikes. When you fund your cars and truck or lease an automobile, this type of insurance is necessary. Uninsured/underinsured driver (UM) insurance coverage: If an uninsured or underinsured vehicle driver strikes your vehicle, this insurance coverage pays for you and your traveler's medical expenditures and may additionally make up lost revenue or compensate for pain and suffering.

Employer insurance coverage is commonly the most effective option, however if that is inaccessible, get quotes from several providers as several offer price cuts if you purchase even more than one kind of insurance coverage. (https://www.cheaperseeker.com/u/hsmbadvisory)

Hsmb Advisory Llc Can Be Fun For Anyone

Between health and wellness insurance policy, life insurance policy, impairment, responsibility, long-lasting, and even laptop insurance coverage, the task of covering yourselfand believing concerning the unlimited opportunities of what can occur in lifecan really feel frustrating. However once you comprehend the principles and make certain you're sufficiently covered, insurance policy can improve financial confidence and health. Here are one of the most vital sorts of insurance you require and what they do, plus a couple suggestions to avoid overinsuring.

Different states have different regulations, yet you can anticipate medical insurance (which many individuals make it through their company), vehicle insurance policy (if you possess or drive a vehicle), and house owners insurance policy (if you have residential or commercial property) to be on the checklist (https://www.viki.com/collections/3896580l). Compulsory sorts of insurance coverage can transform, so check out the most recent laws every now and then, specifically prior to you renew your plans

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)

:max_bytes(150000):strip_icc()/dotdash-medicaid-vs-chip-understanding-differences-v2-ce78e3fa912a4806a1f58a166cfd649f.jpg)